Leapfrogging is incredibly difficult in a chip industry dominated by the giants, so most of Chinese IC companies can only grab a slice of the cake that the giants have ignored. However, because of the technological breakthroughs of these IC companies in the above fields, together with the support of capital and policies, the Chinese IC industry expects to catch up with or even surpass the global leaders.

Leiphone.com planned a series of articles "Champions Behind China's Chip Industry", so that more people know those semiconductor workers and companies which have been devoting to the industry quietly in the past decades, and understand their actual lives behind breakthrough in the market segment and future development prospects.

The iPhone4, released by Apple in 2010, ushered in the era of smartphones and changed the fortunes of many companies and individuals. Companies that are part of Apple's supply chain make a lot of profits. Even if they are not part of Apple's supply chain, they are benefiting from new market opportunities created by smartphones, such as power bank and true wireless stereo (TWS) earbuds.

Dong Guanbin, who entered the IC industry in 2000, is one of the stars of times. He started a new entrepreneurial journey in 2011 after the emergence of iPhone4. With his keen sense of the market, he seized the opportunity of the surging demand for power bank and solved the survival problem of his company two years later.

In 2016, Apple AirPods became the main product in the TWS earbuds market. With the experience in the power bank market, Dong Guanbin once again seized the opportunity to make 2020 the milestone of the company's annual revenue exceeding RMB 100 million.

Thinkplus Semiconductor, founded by Dong Guanbin, focuses on the power management IC of lithium batteries, an IC that rarely attracts the attention of ordinary consumers, but is an essential part of all electronic devices because it affects the battery life, charging and other experience. Because of this, Dong Guanbin called himself and his company the "sweeping monk" in the IC industry.

Dong Guanbin, who keeps up with the two waves of Apple headset products, is striving for the goal of the company's annual revenue from 100 million to 1 billion. He will still pay attention to the next opportunity that Apple may bring, but he predicts that the wearable market will not continue to be dominated by Apple headset products in the future.

In the past ten years, under the background of the rapidly changing market environment, the revenue scale of the company has changed from 0 to more than 100 million. Dong Guanbin is a microcosm of Shenzhen entrepreneurs who benefit from Apple products. The achievements of Thinkplus Semiconductor today let us understand how IC companies adapt to the ever-changing market, and also verify the importance of a firm long-term development strategy for semiconductor industry in China.

Dong Guanbin, General Manager of Thinkplus Semiconductor

A sweeping monk with 10 years of experience is focusing on the power management IC market, and has gone through a long way of entrepreneurship for 10 years

Dong Guanbin graduated in mechanical and electronic major in 2000 and joined an IC company where he engaged in research and development. However, he was very unfamiliar with the IC industry, not to mention the analog ICs, the main business of the company. Four years later, Dong worked for a company specializing in computer accessories where he continued research and development work, but then he also had the idea of a career change.

"At that time, I didn't have a deep understanding of the IC industry and could not see its future, so I decided not to work in the IC industry." Dong told Leiphone, "After deep thinking about it for several months, I finally decided to stay in the IC industry and made up my mind to move to Shenzhen."

Dong came to Shenzhen in 2007 and changed the position from R&D to sales. He found that the cost of living in Shenzhen was lower than in Beijing and Shanghai, and that the city had a mature electronics industry chain, making it ideal for creating a company.

In 2011, Dong founded Thinkplus Semiconductor in Shenzhen and borrowed the office from a friend in the first year.

"When Thinkplus Semiconductor was founded, our goal was to solve the survival problems of the company in the first three years, and to locate a market worth entering." "We started with the simplest method and the smallest cost to start the company. Because my partners and I were familiar with the whole R&D process of analog ICs, we developed our own IC product and didn't go to bed until two or three a.m. every day at that time."

After a month’s hard work, Dong and his partners successfully created the first IC product. In the first three years of their business, nearly 60 ICs were produced for a single customer for whom they made customized products.

Although Thinkplus Semiconductor served only one customer for the first three years, they had already foreseen the company's future in the power bank market. In addition, Dong was also gradually determined to develop in the field of power management ICs. According to his view, he once hesitated between choosing the power management IC and the touch IC, and finally chose the power management IC because no matter how advanced electronic devices are, they can’t develop without the power management IC, and he never regretted the decision after he made it.

With the emerging power bank product market, Thinkplus Semiconductor received the first order of 1 million ICs

Thanks to an exchange with Li Zhaohua, general manager of Sunmoon Microelectronics, Dong Guanbin was able to find the business opportunity in the power bank market. Li told Dong that the whole market was looking for the power management IC of the power bank. Dong thought this might be an opportunity for Thinkplus Semiconductor. Although he obtained important market information, Dong still made careful and comprehensive analysis before deciding to formally enter the field.

"One of the drawbacks of smartphones popular like iPhone is that the battery cannot be replaced, which makes it difficult to charge the phone when the user is leaving the power supply, so the demand for power bank arised at that moment. At that time, Dopod and HTC were the mainstream smart phones, and Android programs running secretly consumed a lot of power. We thought that if there was a backup power supply that could be used at any time, we could help users solve this problem, so we finally decided to focus on developing in this market." Dong said.

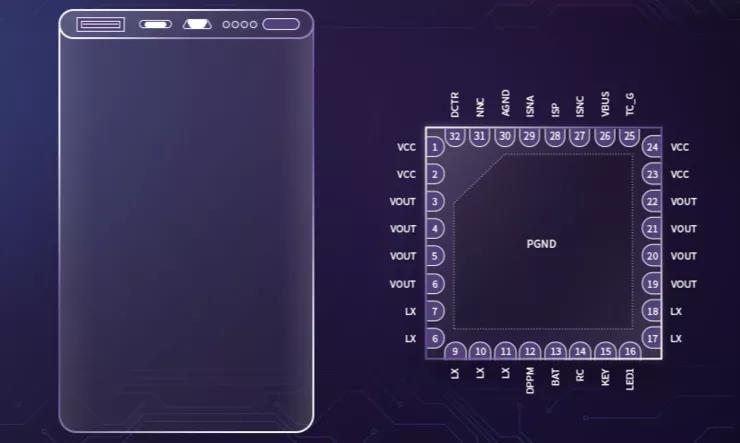

Therefore, Dong decided to enter the power bank market in 2012. By the end of 2013, after numerous attempts and solving technical problems, Thinkplus Semiconductor launched the first power management IC product for power bank, marking the company's official entry into the power bank market.

Thinkplus Semiconductor perfectly seized the opportunity of the power bank, and the demand in the power bank market began to emerge in 2012, grew rapidly in 2013, and began to blow out in 2014.

However, before mass production and customer acquisition, Dong was worried about Thinkplus Semiconductor.

Fortunately, with the introduction of the agent, first order shipment volume of Thinkplus Semiconductor power bank management IC reached 1 million pieces. Because this big customer has a leading position in the market of power bank terminal, other customers were scrambling to use the first power bank IC product MP2310 of Thinkplus Semiconductor, and more than 30 million pieces were shipped in total in 2014 to 2015.

The key to good sales performance of the first power bank IC of Thinkplus Semiconductor lies in its excellent cost performance.

"At that time, the most popular products in the market were synchronous boost ICs of Silergy and GMT. A power bank needs to be equipped with three independent ICs: charging IC + MCU + boost IC, resulting in high overall product cost." Dong said, "Our first generation of power bank IC products integrate independent ICs into a SoC, which costs less than a single boost IC, and are thus highly recognized by a large number of customers."

In 2016, Thinkplus Semiconductor ranked first in the industry for shipments in the mainstream 1A power bank SoC market. In 2017, shipments in the power bank management IC market exceeded 80 million pieces.

Thinkplus Semiconductor successfully led the industry development trend of power management ICs for power bank, integrated SoC became the mainstream product, and a number of discrete device companies were forced to withdraw from the market competition.

However, Thinkplus Semiconductor's performance in this market is not impeccable. With the development of the market, homogenization competition becomes more and more fierce. Since 2015, the demand for power bank has gradually shifted from low-current charging to high-current charging. At that time, Thinkplus Semiconductor's technology in high current charging has not yet matured, resulting in the loss of some customer resources.

Fortunately, the rapid changes in the consumer electronics market have brought new opportunities. After 2015, the power bank market entered a plateau due to the increasing capacity of mobile phone batteries, the addition of fast charging functions, and the popularity of shared charging banks.

Thinkplus Semiconductor still maintained a good market share in the power bank management IC market. At this time, Dong Guanbin began to sum up experience and prepared to go all out to enter the TWS earbuds market.

Thinkplus Semiconductor became the champion of TWS earbuds IC sales with the pioneering spirit

Like a repeat of history, or one of the secrets of Dong Guanbin's success, he once again took the lead in capturing the market demand for power management IC, TWS (true wireless stereo) earbuds for this time.

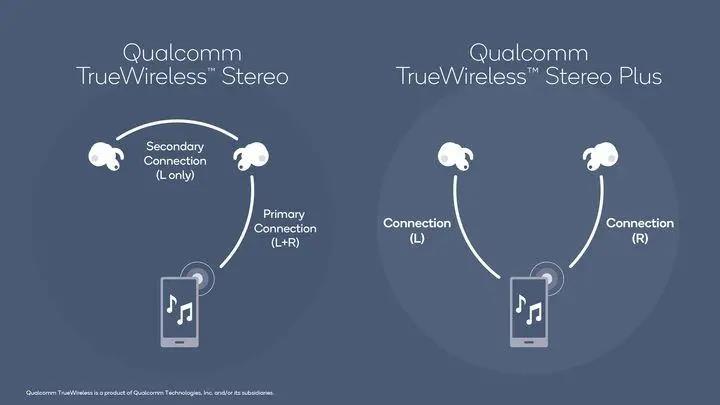

Before the popularity of TWS, there are plenty of Bluetooth wireless earbuds. Because of technical limitations, this kind of wireless earbuds can only be connected to the mobile phone through the main earbuds, and then the cable transmits the audio signal to the secondary earbuds, and the product form becomes a monaural or neck-hanging type.

Photo source: Qualcomm

In 2016, Apple's newly released iPhone7 / 7Plus removed the 3.5mm earbuds port and launched a new TWS earbuds AirPods. Even if the sales date of AirPods was delayed and it took at least a month and a half to receive a new product after launch, it didn’t stop many consumers from buying.

Even so, it's doubtful that Apple will be the dominant player in the TWS earbuds market in 2017. "Once I communicated with a friend who makes Bluetooth ICs, he kept stressing that I should pay attention to the TWS market, because this field will usher in great development." "It's not easy to really decide to enter a new market, even with previous experience in the power bank market," Dong said.

Thinkplus Semiconductor was found by its first TWS customer for power bank management IC products.

"We focused more on the usage of products earlier and less on customer experience. Our power management IC was adopted because power bank and TWS earbuds have similar requirements for power management IC, and Thinkplus Semiconductor’s IC has the advantages of low power dissipation and low-current shutdown. Even if the IC for a power bank is not optimal for TWS earbuds, it is the right choice at that point in time." Dong said.

What ultimately made Dong decide to design a power management IC specifically for TWS earbuds was the rapid growth of the market. In 2017, the IC shipments that Thinkplus Semiconductor supplied to TWS customers increased from hundreds of thousands to millions, and in 2018, the number increased rapidly to the level of ten million.

In 2019, Thinkplus Semiconductor's TWS power management IC shipments have exceeded 100 million pieces, ranking first in the industry for the market share, and the manufacturers of well-known brands such as Xiaomi, OPPO, OnePlus, realme, Meizu, Transsion, and 1MORE have established cooperative relations with Thinkplus Semiconductor.

However, it was in September 2018 that Thinkplus Semiconductor officially launched the project of designing power management IC for TWS earbuds. Before that, it spent more than 8 months collecting market information while serving customers.

"The experience of the power bank market tells us that we cannot spend more time on customers whom we have already worked with, but should directly understand the complex needs of brands and customers, and then meet those needs." Dong said, "We have reduced the original scheme of a TWS earbud that requires 3-4 ICs to only one Thinkplus Semiconductor power management IC, and then together with MCU to realize all functions. Not only is the overall area of IC smaller, but also its electrical performance is not inferior to that of international brands. In some key technologies, it is also more in line with the system requirements."

With a more integrated IC, SY8801, Thinkplus Semiconductor's first power management IC specially designed for TWS earbuds, which was launched in May 2019 and mass produced in 2020, Thinkplus Semiconductor has won the favor of manufacturers of well-known brands at home and abroad such as Baidu, NetEase, EDIFIER, Harman and JBL, and achieved annual sales of over RMB 100 million. At the same time, it received the series A investment from Stony Creek Capital, a famous investment firm.

According to the ranking of TWS power management IC shipments released by Sunrise Big Data, Thinkplus Semiconductor shipped 24.3 million ICs in March 2021, surpassing Texas Instruments ranking second. For the success of Thinkplus Semiconductor to surpass the performance of international industry giants, Dong Guanbin modestly believes that it may be a "tiger" nap - a rare opportunity.

Then Thinkplus Semiconductor forged ahead into the market for power management IC products used in TWS earbuds.

"We did not enter the power management IC market for TWS earbuds at the beginning, but only made power management IC for batteries, mainly because the market development situation was not clear at that time." Dong said, "Our earbuds power management IC has 70% smaller circuit board area than the original design product, with lower power dissipation, and contains more than a dozen functions, making this IC also very popular in the market.”

According to Dong's understanding of the law of consumer electronics market, consumer electronics products will be upgraded once every two years, after three product upgrades, the market will readjust once. Therefore, the TWS earbuds market still has a period of rapid growth of 3-4 years.

Dong believes that the power management IC of TWS earbuds will develop towards higher efficiency and higher integration, and will have more functions such as fast charging and wireless charging.

"The product range of TWS earbuds as audio devices has been basically defined, and the market acceptance has also been very high, but it will develop towards more complex products in the future, and it is not clear what sensors and new features will be integrated into TWS earbuds." This is the view of Dong.

Obviously, for a relatively small company like Thinkplus Semiconductor, keeping pace with market demand and offering cost-effective products is the key to survive today. But even if the market share of the power management IC segment of power bank and TWS is large enough, Thinkplus Semiconductor still needs to keep moving forward in order to become bigger and stronger.

Revenue increased from hundred million to billion level

The advantage of the consumer electronics market is that the demand is huge, but the overall gross profit margin is low, and it is easy for companies to be eliminated if they cannot keep up with the changes in the market.

Dong Guanbin has worked in the IC industry for 20 years. The development history of the company for 10 years shows that in the field of consumer electronics, it is right to pay attention to Apple, and Apple will continue to take the lead in the consumer electronics market. However, Apple may not be the dominant player in the wearable product market, so it is still too early to make a conclusion whether Apple can maintain a strong leadership in the wearable product market.

"Anyway, in order to maintain our market competitiveness, we should work closely with our customers and understand their needs deeply." Dong said.

Thinkplus Semiconductor is about to embark on a new journey in a new decade of the company's development in 2022. In the past decade, the products of Thinkplus Semiconductor have started from scratch. The main market has been from power bank to TWS earbuds. The number of team members has grown from 2 to nearly 100, and the revenue has grown from zero to more than 100 million, with a compound annual growth rate of 50% in the past two years.

Dong's goal in the next decade is to accelerate the revenue transition from RMB 100 million to USD 100 million.

Obviously, it is still difficult to achieve this goal only by the consumer electronics field. So Dong has turned to aim at the industrial electronics and automotive electronics markets.

"The industrial electronics and automotive electronics markets change relatively slowly. Compared with the consumer electronics market, the overall scale of these markets is smaller, but these two markets have higher gross profit margins, which can not only enrich the types of product lines, but also improve the company's overall product gross profit margins." Dong plans development of Thinkplus Semiconductor in the next 10 years along this route.

Automotive electronics and industrial electronics are typical enterprise markets, which are quite different from the consumer electronics market which Thinkplus Semiconductor is familiar with in terms of product features and market demands. However, Dong said that Thinkplus Semiconductor would definitely invest in these two markets, which is a necessary choice for the development of Thinkplus Semiconductor. Currently, the company is also communicating with potential customers in these two markets for cooperation. In the future, Thinkplus Semiconductor will reduce the proportion of consumer electronics revenue year by year, carry out diversification planning and achieve higher gross profit margin.

"The development of IC industry in China should still be centered on system innovation, because innovative systems will bring new demand for ICs." Dong further noted, "Although analog ICs are not pursuing advanced manufacturing procedures as quickly as digital ICs, analog ICs are also continuing to evolve. Over the past decade, the key to restricting the development and improving competitiveness of China's analog IC industry is to develop advanced manufacturing. Now the gap between domestic advanced manufacturing level and international advanced level is getting smaller and smaller. In addition, the development of advanced packaging technology is also conducive to the development of analog IC companies including our company and the promotion of product competitiveness."

Attention is not often paid to analog ICs, but they are essential for electronic equipment. Dong Guanbin, who has been in the industry for 20 years, likens himself to a sweeping monk. He believes that both the country's technology industry and the IC industry need a lot of people who devote themselves quietly to the research, development and building of underlying technologies and products.

"Only by working hard and sticking to the long-term development strategy can our core capabilities become stronger and stronger, and can we quickly adapt to the needs of different markets and various systems." Dong said, "Only in this way can we achieve the goal of sustainable development in the next 10 years in a competitive global market."

Words in the End

The deep communication between Leiphone and Dong lasted for two hours. The man who has worked in IC industry in China for 20 years and steered Thinkplus Semiconductor for 10 years is a representative figure who sticks to the long-term development strategy of China's IC industry. He is not good at telling stories and concepts, but conquering the market with real products.

The performance of Thinkplus Semiconductor in the consumer electronics market shows that the company was able to capture the new market opportunity generated by Apple. It is a common case to win the market with a more integrated IC, but the difference is in the product demands and functions. Thinkplus Semiconductor's success is not easy, and essentially, the reason for its success is that it is willing to continuously invest 15% of its annual revenue in R&D to continuously accumulate core technology.

Thinkplus Semiconductor is not only the representative of Shenzhen startups, but also the representative of many companies who have achieved breakthroughs in the IC segment market. The company doesn’t talk about vague concepts, doesn’t package themselves, but has cultivated keen market insight through continuous attempts and practices.

It wins the market by higher cost performance against many competitors, but still takes a longer view than other peers, and is willing to spend time and energy to create more competitive products, so as to achieve the goal of leading the industry.

With the continuous growth of Chinese IC system companies and the progress of advanced manufacturing, Chinese IC design companies have the opportunity to catch up with the global leading level and go global ten years later, by which time they may really surpass their foreign counterparts.

As Dong Guanbin has always stressed, an IC company, or IC R&D personnel, or even the entire domestic IC industry should stick to the strategy of long-term development, find the law of development of technology and industry, and constantly enhance the core competitiveness. Only in this way can they achieve success.

Dong judged that with the development of Chinese IC industry, there will be many mergers and acquisitions between Chinese IC companies in the future. "If Thinkplus Semiconductor is still there after 10 years, it means that all mergers and acquisitions in China's IC industry have been completed. If there is no Thinkplus Semiconductor after 10 years, it means that the M&A tide comes in earlier."